Wiz Avenue

-

Travel News

Full list of visa free countries for Ghanaian passport holders (Updated September 2025)

Holders of Ghanaian passports have visa-free access to 47 countries, ranking the Ghanaian passport 70th in the 2025 Global Passport…

Read More » -

How To

Financial Planning for Couples: Money and Love

Money and love are two of the most sensitive topics in a relationship. Many couples fight not because…

Read More » -

How To

The Role of Respect in Every Relationship

Every healthy relationship whether romantic, family, friendship, or work related needs one essential ingredient: respect. Without it, love fades,…

Read More » -

How To

Why Listening is More Important Than Talking in Love

In relationships, many people believe that communication is all about talking. But the truth is, listening is even…

Read More » -

How To

How to Apologize and Make Peace After an Argument

Arguments are part of every relationship whether with a partner, friend, or family member. What truly matters is how…

Read More » -

How To

How to Book a Hotel in Ghana as a Foreigner

Visiting Ghana, whether for tourism, business, or study, is exciting and one of the most important things to arrange…

Read More » -

How To

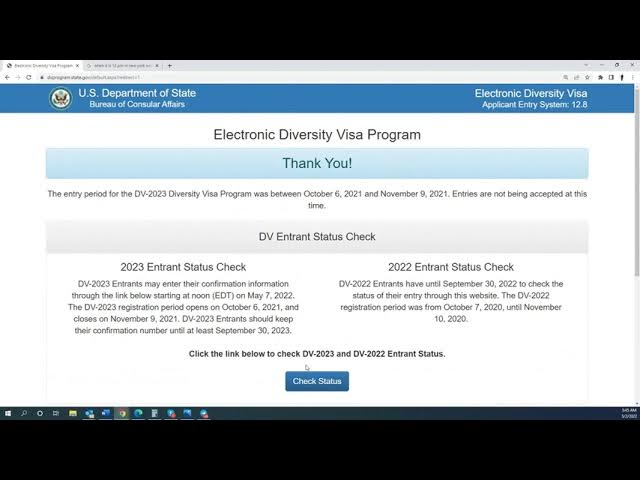

How to Check for DV Lottery Results (Step-by-Step Guide)

Every year, thousands of people around the world apply for the Diversity Visa (DV) Lottery, also known as the…

Read More » -

How To

How to Register a SIM Card for Foreigners in Ghana

If you are a foreigner visiting or living in Ghana, one of the first things you’ll need is…

Read More » -

How To

How to Apply for Permanent Residency Abroad

Many people dream of living, working, or studying abroad long-term. One of the best ways to achieve this is…

Read More »