How to Open a Bank Account in Ghana (Step-by-Step)

Opening a bank account in Ghana is simple and essential if you want to save money, receive payments, or run a business smoothly. Whether you’re a student, worker, or foreigner living in Ghana, here’s a step-by-step guide to help you open an account with ease.

Step 1: Choose the Right Bank

Popular banks in Ghana include:

•GCB Bank

•Ecobank

•Absa Bank

•Stanbic Bank

•Fidelity Bank

•Access Bank

Compare fees, services (ATM, mobile app, international access), and accessibility before choosing.

Step 2: Decide the Type of Account

Most banks offer:

•Savings Account – For saving money with interest.

•Current Account – For frequent transactions (business & personal use).

•Foreign Currency Account – For USD, GBP, EUR, etc.

•Student/Youth Account – With lower charges for young people.

Step 3: Prepare the Required Documents

Generally, you’ll need:

•A valid National ID card (Ghana Card, Passport, Voter’s ID, Driver’s License).

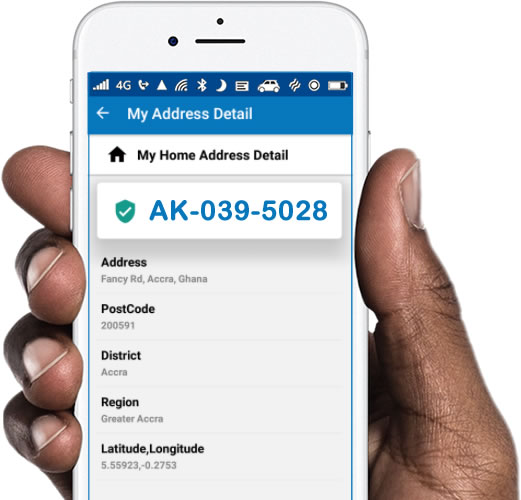

•Proof of address (utility bill, digital address, or tenancy agreement).

•Passport-sized photos (usually 1–2).

•Tax Identification Number (TIN) (for certain accounts).

Foreigners may need a residence permit and passport.

Step 4: Visit the Bank Branch

•Go to the nearest branch of your chosen bank.

•Request for an account opening form.

•Fill in your details carefully (name, address, occupation, etc.).

Step 5: Submit Your Documents

•Attach your photos and photocopies of IDs.

•Provide your digital address (via GhanaPost GPS).

•Some banks may require a reference form (for current accounts).

Step 6: Make Your Initial Deposit

•Most banks require a minimum opening balance (example: ₵50 – ₵200 depending on the bank and account type).

•Deposit cash into your new account.

Step 7: Collect Your Account Details

Once approved, you’ll receive:

•Your account number

•A bank card (ATM/debit card)

•Access to mobile and internet banking

Step 8: Start Using Your Account

•Deposit and withdraw money at the bank or ATM.

•Send and receive funds through mobile money or transfers.

•Use internet banking for bills, airtime, and online payments.

Final Tips

•Always keep your ID and account details safe.

•Activate SMS alerts to monitor transactions.

•Ask about charges and fees before opening.

•If you travel abroad, consider opening a foreign currency account for easier transactions.

Opening a bank account in Ghana is straightforward if you have the right documents. With your account, you can enjoy financial security, easy transactions, and access to modern banking services.