How To

-

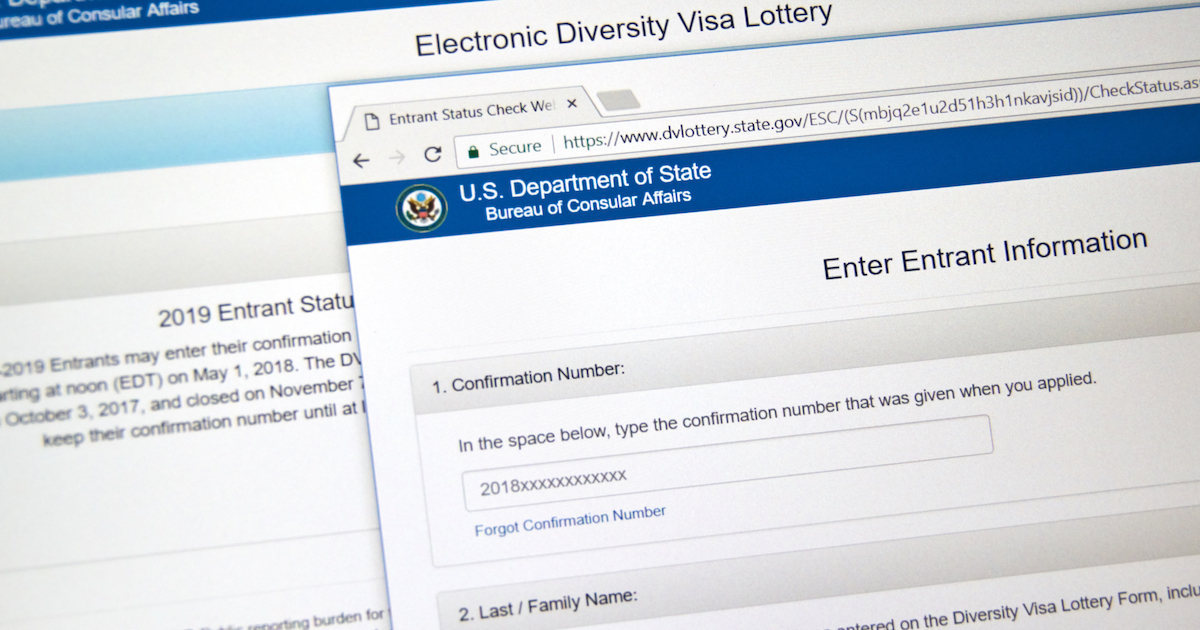

How to Register for a Green Card Lottery (DV Lottery)

The Diversity Visa (DV) Lottery, also known as the Green Card Lottery, is a U.S. government program that allows…

Read More » -

How to Open a Bank Account in Ghana (Step-by-Step)

Opening a bank account in Ghana is simple and essential if you want to save money, receive payments,…

Read More » -

How to Apply for a Work Permit Abroad

If you’re planning to work in another country, one of the most important documents you’ll need is a…

Read More » -

How to Register for a Forex Account to Start Trading

Foreign exchange (forex) trading is one of the largest financial markets in the world. It allows people to…

Read More » -

How to Register for an International Driving Permit (IDP)

If you’re planning to travel abroad and want to drive in another country, you will likely need an International…

Read More » -

How to Register for Health Insurance Abroad if You’re Travelling

Travelling abroad is exciting, but one important thing you shouldn’t overlook is health insurance. Medical care in foreign countries…

Read More » -

How to Register Your Land or Property with the Lands Commission in Ghana

Owning land or property in Ghana is a big achievement, but registering it with the Lands Commission is…

Read More » -

How to Get Good Topics for a Research Project as a Student

Choosing the right research topic is one of the most important steps in academic success. A well-chosen topic…

Read More » -

Best Savings Accounts for Students & Young Adults in Ghana

Whether you’re in school or just starting out, choosing the right savings account can help build financial habits and…

Read More » -

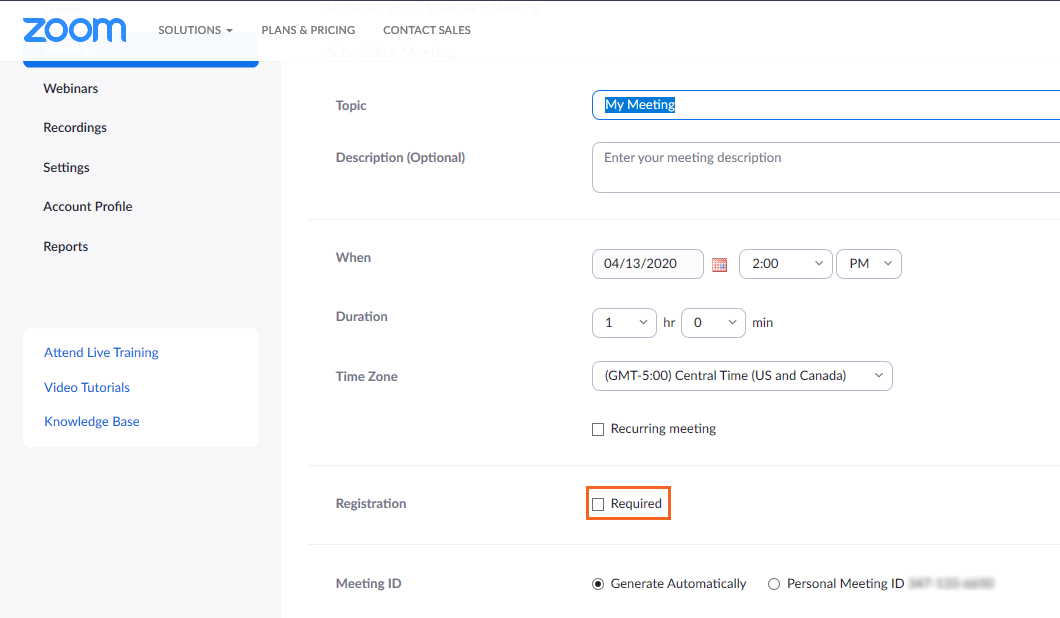

How to Register for Zoom, For School work

In today’s digital world, remote work and online learning have become part of our daily lives. Three of…

Read More »